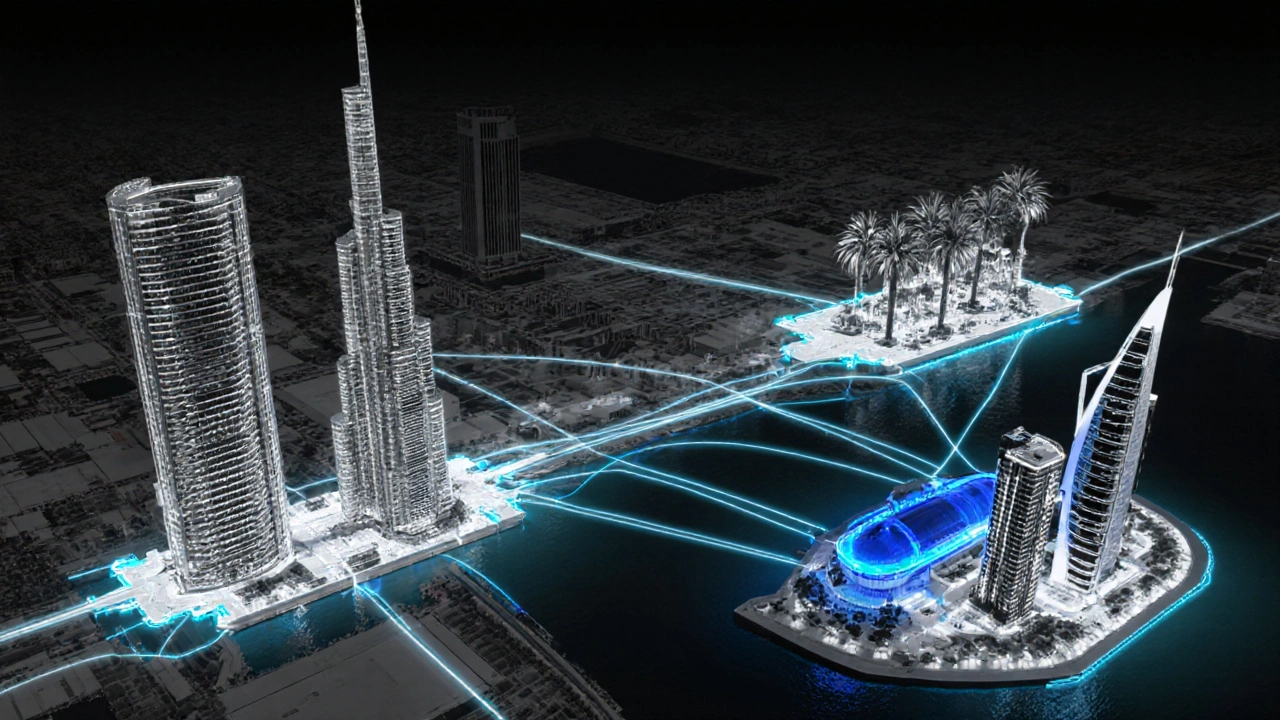

You’ve seen the photos: the Burj Khalifa piercing the sky, Palm Jumeirah shaped like a palm tree from above, luxury villas lining canals in Dubai Marina. But have you ever wondered who actually owns all of it? Not just the buildings, but the land, the towers, the islands? It’s not a bunch of random investors or foreign buyers. The real estate landscape in Dubai is dominated by a handful of powerful entities - mostly government-backed giants that don’t just build properties, they shape the entire city’s future.

Who owns most of the real estate in Dubai?

The single largest owner of real estate in Dubai is Emaar Properties. Founded in 1997, Emaar doesn’t just build homes or offices - it builds entire neighborhoods, districts, and landmarks. Think Burj Khalifa, Dubai Mall, Downtown Dubai, and even the residential communities like Arabian Ranches. Emaar controls over 30% of the total developed land in Dubai, making it the undisputed leader. But it’s not alone. Other major players like Nakheel, Dubai Properties, and Meraas hold massive portfolios too. Together, these four companies own more than 60% of all prime real estate in the emirate.

Why does this matter to you?

If you’re thinking of buying property in Dubai, understanding who owns what isn’t just trivia - it affects your investment. Properties built by these giants come with guaranteed infrastructure, long-term maintenance, and higher resale value. Why? Because these companies have the resources and political backing to keep their areas thriving. A villa in a community developed by Nakheel will likely have better water access, road maintenance, and security than one built by a small developer who vanished after handing over keys. You’re not just buying a house - you’re buying into a system.

The big four: Who’s really in control?

Let’s break down the top four real estate developers shaping Dubai’s skyline:

- Emaar Properties: The heavyweight champion. Owns over 120 million square feet of developed space. Their projects span luxury, mid-range, and affordable housing. They also operate Dubai Mall - the world’s largest shopping center by total area.

- Nakheel: The island builders. Best known for the Palm Jumeirah, Palm Deira, and The World islands. Nakheel controls over 150 million square feet of land - much of it reclaimed from the sea. Even though they faced financial trouble after 2008, they’ve bounced back hard, now focusing on affordable housing and mixed-use communities like Dubai Hills Estate.

- Dubai Properties: A subsidiary of Dubai Holding. They specialize in master-planned communities like Jumeirah Beach Residence (JBR), Business Bay, and Al Barsha. Their strength? Creating walkable, transit-connected neighborhoods with retail, schools, and parks built in from day one.

- Meraas: The flashy newcomer. Founded in 2007, Meraas brought us City Walk, Bluewaters Island (home to Ain Dubai), and La Mer. They focus on lifestyle-driven developments - places designed for experiences, not just living. Their properties attract tourists and young professionals looking for vibe over volume.

These four don’t just compete - they collaborate. Emaar and Nakheel often partner on infrastructure projects. Meraas uses Dubai Properties’ expertise to manage rentals. It’s less about rivalry and more about a tightly knit ecosystem.

Government backing: The hidden force

None of these companies operate like regular private firms. They’re all owned or heavily controlled by Dubai’s government through entities like Dubai Holding, Dubai Inc., and the Real Estate Regulatory Agency (RERA). That means their funding isn’t just from sales or loans - it comes from sovereign wealth, oil revenues, and state-backed credit lines. This is why Emaar can start a 10-year project without needing immediate returns. Most private developers in other countries would collapse under that kind of pressure.

It also means these developers can override zoning rules, fast-track approvals, and even relocate entire communities if needed. That’s how they built the Palm Jumeirah - a project that would’ve taken decades elsewhere, done in under six years.

What about foreign buyers? Don’t they own a lot?

Yes - but not the land. Foreign buyers own about 25% of residential units in Dubai, mostly in freehold areas like Dubai Marina, Palm Jumeirah, and Downtown. But here’s the catch: they don’t own the underlying land. The land is still held by Emaar, Nakheel, or Dubai Properties. Foreigners own the building or apartment on top of it, like a long-term leasehold. So while you might live in a penthouse in JBR, the land beneath it belongs to Dubai Properties. You’re renting the ground, even if you own the unit.

This structure protects the emirate’s control. Even if a foreign investor sells their apartment ten times, the land stays with the developer. It’s a clever system - it lets Dubai attract global capital without giving up territorial sovereignty.

How do these developers make money?

It’s not just selling apartments. Their business model is layered:

- Land acquisition: The government gives them large plots, often at low cost.

- Infrastructure investment: They build roads, sewage, water, electricity - and then charge developers who want to build on their land.

- Commercial leasing: Emaar earns billions from Dubai Mall’s tenants - from Louis Vuitton to food courts.

- Rental income: Many units are held as long-term rentals, especially in Dubai Hills and JBR.

- Project fees: They charge other developers to use their branded infrastructure - like sewage systems or security networks.

Think of them less as builders and more as city operators. They don’t just sell houses - they sell lifestyles, convenience, and long-term value.

What’s next? The new frontiers

Right now, the big players are shifting focus. Emaar is expanding into affordable housing in Dubai South. Nakheel is launching new islands - including the massive Dubai Islands project, set to add 300 square kilometers of land. Meraas is building a new waterfront district called “The Sustainable City” - a carbon-neutral community powered by solar and smart grids.

And then there’s the new kid: Dubai Future Foundation, which is quietly acquiring land for AI-driven smart cities. They’re not selling homes yet - they’re building the infrastructure for a future where robots deliver groceries and AI manages traffic. Whoever controls that land will own Dubai’s next decade.

Comparison: Who’s the best for investors?

If you’re looking to buy property, here’s how the top four stack up:

| Developer | Best For | Price Range (per sq. ft.) | Rental Yield | Resale Value |

|---|---|---|---|---|

| Emaar | Luxury, long-term appreciation | $800-$1,500 | 5-7% | Very High |

| Nakheel | Family living, affordability | $450-$800 | 6-8% | High |

| Dubai Properties | Urban convenience, transit access | $700-$1,200 | 5-6.5% | High |

| Meraas | Tourists, young professionals, lifestyle | $900-$1,600 | 4-6% | Medium-High |

Bottom line? If you want steady growth and high resale, go with Emaar or Nakheel. If you want short-term rental income from tourists, Meraas might be your pick. But if you’re in it for the long haul - and you want your property to hold value through market cycles - stick with the giants.

Frequently Asked Questions

Is it safe to buy property from these big developers?

Yes - and here’s why. All major developers in Dubai are regulated by RERA (Real Estate Regulatory Agency). Every project must be registered, and buyer funds are held in escrow accounts until construction milestones are met. You can verify any project on the RERA website. Emaar, Nakheel, and Dubai Properties have completed over 100 projects with near-zero legal disputes. That’s rare anywhere in the world.

Can foreigners buy land in Dubai?

No - not outright. Foreigners can only own freehold property in designated areas, meaning they own the building, not the land underneath. The land remains owned by the developer or the government. This is standard across Dubai. Even if you buy a villa in Palm Jumeirah, the plot it sits on belongs to Nakheel. You get a 99-year lease, which is effectively permanent.

Which developer has the most units under construction right now?

As of 2025, Nakheel leads with over 80,000 units in development - mostly affordable housing in Dubai Hills, Al Qudra, and new islands. Emaar is close behind with 65,000 units, but many are luxury condos. Nakheel’s strategy is volume and accessibility - they’re building for the middle class, not just billionaires.

Do these developers ever go bankrupt?

Not really. Even during the 2008 crash, Nakheel paused projects but didn’t collapse. The government stepped in with bailouts and debt restructuring. These aren’t public companies you can buy stock in - they’re state-controlled. If one runs into trouble, Dubai’s sovereign wealth fund absorbs the losses. Your investment is protected by the emirate’s financial power.

Should I avoid smaller developers?

Not necessarily - but be cautious. Smaller developers can offer lower prices and unique designs. But check if they’re RERA-registered, ask for proof of land ownership, and never pay more than 10% upfront. Many small developers disappeared after 2008. Stick to ones with completed projects and visible offices. If they don’t have a physical presence, walk away.

Final thought: It’s not about who builds - it’s about who controls

Dubai’s real estate isn’t a free market. It’s a carefully managed system where the government, through its developers, controls land, pricing, and supply. That’s why prices don’t crash like they do in other cities. And that’s why your investment here is safer than in most global markets. You’re not just buying a home - you’re buying into a machine that’s designed to last. The question isn’t who owns the most real estate. It’s: do you want to be part of the system that built Dubai - or just an outsider trying to catch a ride?

Hamza Shahid

November 13, 2025 AT 12:43Let’s be real - this whole ‘government-controlled real estate empire’ narrative is just state propaganda dressed up as financial advice. Emaar doesn’t ‘build neighborhoods’ - they bulldoze communities and slap a luxury label on it. And don’t even get me started on Nakheel’s ‘reclaimed islands.’ That’s just environmental vandalism with a billion-dollar price tag. You call it ‘stability’? I call it a Ponzi scheme backed by oil money and forced labor. Wake up.

Kate Cohen

November 15, 2025 AT 09:03OMG I JUST REALIZED THIS IS LIKE IF THE GOVERNMENT WAS A DATING APP AND THE LAND WAS THE PROFILE 😍 THEY’RE NOT SELLING HOMES THEY’RE SELLING A LIFESTYLE 💫 LIKE A BEAUTIFUL DREAM WHERE YOU LIVE ON A PENGUIN ISLAND AND EVERYTHING IS PERFECT 🌊🌴✨ I MEAN LOOK AT THE PALM JUMEIRAH IT’S LIKE A GIANT PICTURE OF A PALM TREE FROM SPACE WHO DOESN’T WANT THAT?? 🤯 I’M CRYING JUST THINKING ABOUT IT 😭❤️

Jumoke Enato

November 16, 2025 AT 07:18You people keep saying Emaar owns 30 percent of developed land but you forget to mention that the UAE government owns 100 percent of the land before handing it over so technically no private entity owns land at all and your whole premise is flawed because you’re confusing ownership of structures with ownership of the earth itself which is a fundamental misunderstanding of property law in Dubai and frankly your entire article reads like a brochure written by a PR firm hired by Dubai Holding and if you think foreign buyers are just renting the ground you’re wrong they’re paying for a 99 year leasehold which is legally binding under UAE law and the land is held in trust by the developer not owned by them and this is basic real estate terminology you should know if you’re writing something this long

Marc Houge

November 17, 2025 AT 11:43Hey - just wanted to say this is one of the clearest breakdowns I’ve seen on Dubai real estate. A lot of people think it’s just rich people buying penthouses, but this explains why the system actually works. The infrastructure part? Genius. You’re not just buying a condo - you’re buying into a city that’s engineered to last. And yeah, foreign buyers don’t own the dirt, but that’s not a flaw - it’s a feature. Keeps things stable. Keep posting stuff like this. 👏

Brice Maiurro

November 17, 2025 AT 19:37so i was just reading this and i think i just had a mini existential crisis?? like... if the land is owned by the government and i buy an apartment... am i really owning anything?? or am i just renting a box in a very fancy cage?? 🤯 i mean i know its legal and all but like... my whole life i thought buying a house meant you owned the ground under your feet... now im just sitting here wondering if my future 'home' is just a really expensive hotel room with better views

Diana Farrell

November 17, 2025 AT 23:23This is so cool! Dubai is basically building the future and we get to watch it happen. 🌆 I love how they’re thinking long-term - not just flipping properties but creating actual communities. And the fact that they’re investing in solar-powered cities?? That’s next level. If you’re looking to invest, don’t just chase the cheapest unit - go for the ones with real vision behind them. You’ll thank yourself in 10 years. 💪✨

Emily Wetz

November 18, 2025 AT 18:43It’s not about ownership it’s about control and control is the ultimate luxury. The real estate isn’t for people it’s for permanence. The land is a canvas and the developers are the artists painting with steel and glass and ambition. Foreign buyers? They’re just guests in someone else’s dream. And that’s beautiful in a way. We all want to belong somewhere. Dubai just lets you rent the illusion of belonging. And somehow that’s enough.

Jamie Williams

November 19, 2025 AT 09:53Let’s cut through the PR noise. These ‘developers’ are fronts. The real owners are the ruling family and their offshore shell companies using sovereign wealth funds to launder global capital under the guise of ‘urban development.’ The Palm Jumeirah? A money laundering island. The Burj Khalifa? A monument to debt. And don’t tell me about RERA - it’s a theater. Every ‘registered’ project is pre-approved by the same people who own the land, the banks, and the construction permits. This isn’t real estate. It’s a geopolitical hedge fund with elevators. And the ‘middle class’ housing? That’s just bait to attract foreign workers who’ll keep the city running while the elite sip champagne on rooftops they’ll never pay for. Wake up. This isn’t progress. It’s colonialism with Wi-Fi.